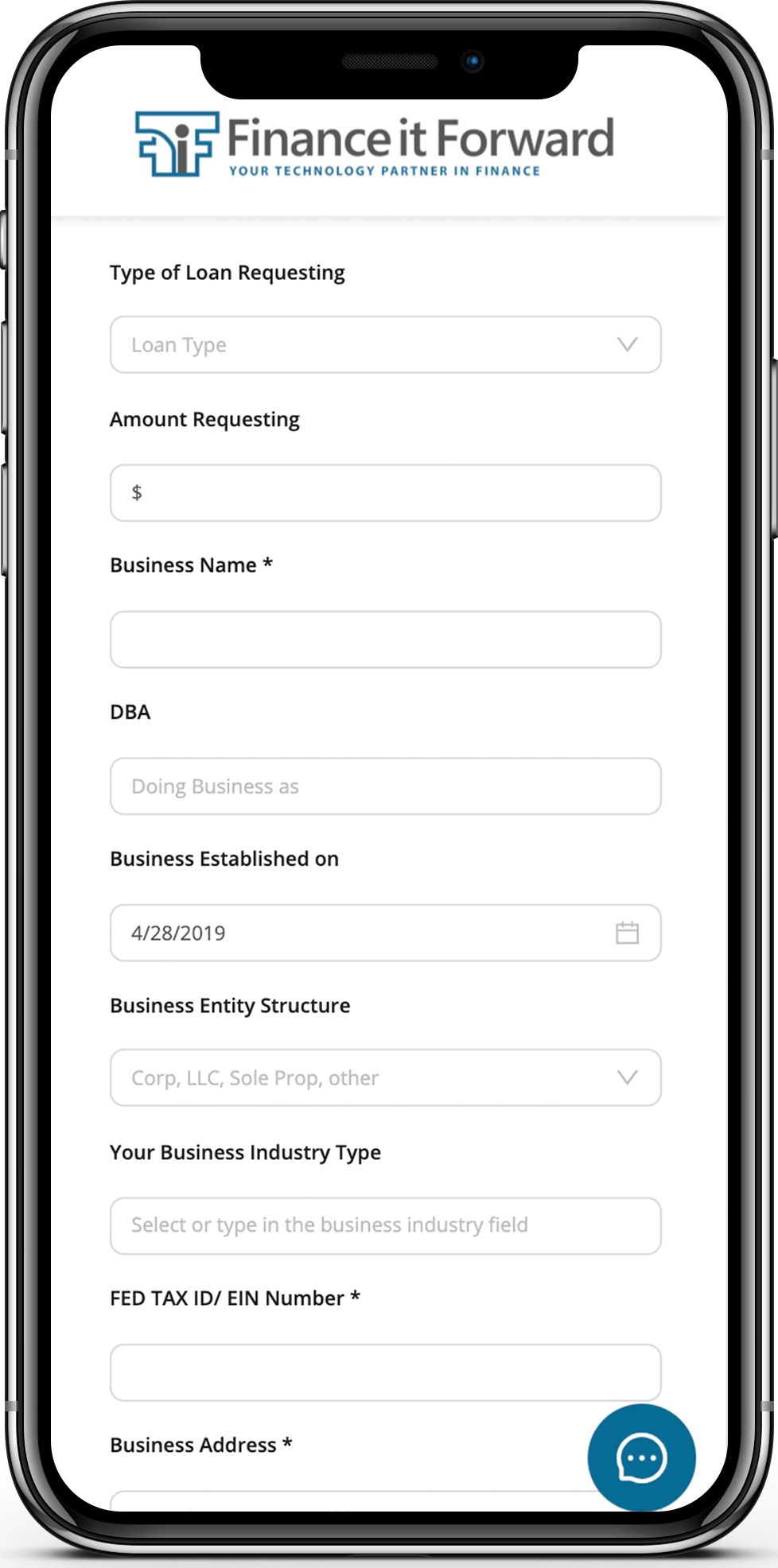

Application Process

Online smart application process with instant approval

Equipment Financing/Leasing

Being a technology firm partnering with various investor categories allows Finance...

Business loan and line of credit

Most small and medium-size operations rely on their cash flow to...

about us

We have dedicated most of our industry knowledge along with the technology aligned to equipment vendors and manufacturers.

Finance IT Forward technology and its staff was built to serve the equipment financing industry. From there we evolved into other types of loans and allocated more to help clients with their other financial needs.

Access business loans up to $5,000,000 from the comfort of your own device.

- Select your loan type

- Input your business information

- Obtain same day approval

(Does not impact the credit score)

Benefits of Leasing

Leasing with Finance IT Forward is efficient and practical.

Leasing is one of the fastest growing ways of acquiring equipment in business today. Recent surveys found that 80% of U.S. businesses lease at least some portion of their equipment and the companies that choose leasing range from the largest Fortune 500 firms to the local family business. A growing business often faces the dilemma of limited cash flow and the need to add equipment. Leasing can put that equipment to work for you with real cash flow advantages without major capital investment.

Cash flow

By making monthly payments, businesses can pay for the equipment with the improved cash flow generated from their new technology. Leasing affords a variety of options to match payment terms to business cash flow, whether cash flow is project-based, seasonal or related to expansion, etc.

Obsolescence protection

Leasing allows you to match payment plans to the equipment’s expected useful life. Leasing provides flexibility at the end of the term to allow you to either take ownership of the equipment or walk away and acquire new technology. The result is a managed solution that allows business to maintain the most current technology.

Tax treatment and benefits

You may be able to write off 100% of your lease payments from your corporate income because the IRS generally does not consider an operating lease to be a purchase. Please consult your accountant for the exact application for your business.

100% Financing

Leasing typically does not require a large down payment. You can finance up to 100% of the equipment cost. In many cases, service, supplies, installation, warranty and other soft costs can be included in the lease. This gives you more money to invest in other revenue-generating activities and makes it easier to afford multiple products.

Speed

In most cases, First Financial can approve businesses for up to $250,000 in equipment lease financing with a one page credit application. Approval can usually be secured in less than 24 hours.

Conserve Cash and Bank Lines

Preserve cash and bank line by using equipment leasing as an alternative form of financing specifically for capital equipment. Use this financing option to maximize liquidity and access to capital by preserving cash and bank lines for other business needs.

Customized solutions

A variety of leasing products are available, allowing you to tailor a program to fit your business needs. So whether you are looking for programs fit for expanding your business or a product that consolidates your multiple leases into one, First Financial’s featured solutions are customized to fit your needs.

Send us a quick message

Feel free to send us a message via our website portal.

We respond to messages required in 24 hours.

We respond to messages required in 24 hours.